Credit Karma App Case Study

Credit Karma helps you stay on top of your financial health by offering free credit scores, reports, and personalized insights—all in one place. With tools to track, manage, and improve your credit, it’s never been easier to take control of your financial future

- Track Your Credit

- Personalized Offers

- Improve Your Score

- Instant Alerts

- Free Credit Reports

Industry

Finance

Services

Credit Monitoring

Business Type

B2C

Build your ideas

Innovation

Client expectations

Credit Karma aimed to provide a reliable, user-friendly credit management platform, empowering users to monitor and improve their credit through accessible, real-time insights and secure data management.

Real-Time Credit Monitoring and Alerts

Enabled instant notifications for credit changes, helping users stay informed. This proactive approach fosters trust and supports timely financial decision-making.

02

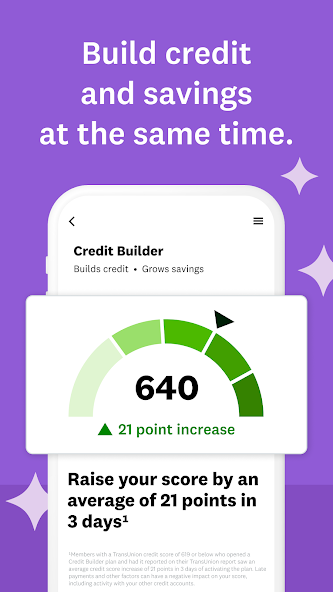

Personalized Credit-Building Insights

Delivered data-driven advice tailored to user profiles, offering actionable steps. This personalized support helps users improve credit scores and overall financial wellness.

03

Comprehensive Credit Report Access

Granted access to full credit reports for transparency, enabling users to track credit history and make informed financial improvements.

Intuitive User Interface and Navigation

Designed an accessible, user-friendly interface that simplifies access to tools, increasing engagement and satisfaction for seamless credit management.

05

Robust Security and Privacy Protocols

Integrated advanced security measures to protect user data, ensuring privacy and building user trust in the app’s secure environment.

Solution provided

1. Free Credit Score Access

Get your updated credit score and report for free, forever, with seamless tracking.

2. Personalized Insights

Receive tailored tips and strategies to improve your credit score and reach financial goals effortlessly.

3. Approval Odds Feature

Check Approval Odds for credit cards before applying to maximize chances of approval.

4. Credit Report Monitoring

Track changes in your credit report and get alerts for any suspicious or impactful updates.

5. Loan Offers Transparency

Access detailed loan offers with competitive rates from top lenders, matched to your credit score.

6. Credit Card Recommendations

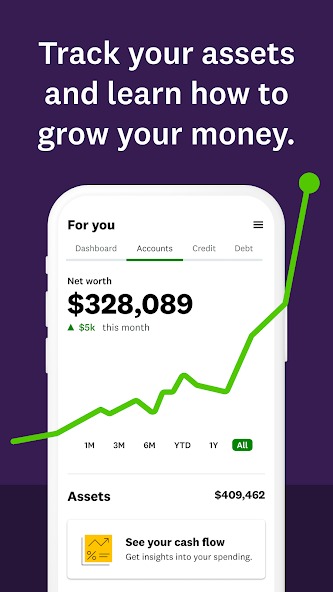

7. Progress Tracking Graphs

8. Secure Data Protection

Your personal data is safeguarded and shared only with your permission for legitimate purposes

9. Loan Repayment Assistance

View repayment examples to understand potential costs and make informed financial decisions.

10. Easy Sign-Up Process

Join in minutes by answering a few security questions and start improving your credit today.

Key Features of The Application

Free Credit Score Access

Allows users to check their credit scores anytime, free of charge.

Personalized Financial Recommendations

Provides tailored advice for credit improvement and financial planning.

Credit Monitoring Alerts

Sends real-time alerts for any changes to a user’s credit report.

Comprehensive Credit Reports

Gives full visibility into credit history, supporting better financial decisions.

User-Friendly Interface

Designed for easy navigation, ensuring a smooth user experience

Robust Security Measures

Protects sensitive data with advanced encryption, ensuring user privacy and trust.

Take the Next Step Towards Efficiency

Reach out now to discuss your project requirements and get a customized solution that fits your business perfectly.

Benefits of the Application

Access to Free Credit Scores Anytime

Users can check their credit scores at no cost, helping them stay informed about their financial standing.

Personalized Financial Recommendations

Customized advice enables users to make proactive improvements in their credit health and achieve financial goals

Real-Time Credit Alerts for Better Protection

Instant notifications of credit changes help users prevent identity theft and respond swiftly to credit updates

Educational Resources for Financial Empowerment

Credit Karma’s guidance and tools support users in understanding credit factors, enhancing their financial literacy.

Technologies used in Credit app

Available on iOS, Android, and web platforms, the app uses data analytics, machine learning, and secure APIs to deliver personalized solutions with a user-friendly interface designed for simplicity and ease of use.

Swift

Kotlin

Flutter

CI/CD

Appium

Our Excution Process

1. Requirment and Gathering

The mobile app development process begins by gathering user requirements and conducting market research. This helps define the app concept, identify the target audience, and set clear project goals to ensure the app meets user expectations.

2. Development

During the development phase, the app’s backend and frontend are built using the right technology stack. Developers focus on speed, scalability, security, performance optimization, and cross-platform compatibility to ensure the app works efficiently.

3. Design and UI/UX

The UI/UX design phase focuses on creating wireframes, prototypes, and mockups that deliver a visually appealing and user-friendly interface. Designers prioritize ease of use, intuitive navigation, and a seamless experience to ensure higher user retention.

4. Testing & Quality Assurance

In the testing phase, the app undergoes quality assurance (QA) to identify and fix bugs, security vulnerabilities, and performance issues. Testing includes functionality checks, user acceptance, and cross-device compatibility to ensure a flawless user experience.

5. Deployment & Post-Launch Support

After successful testing, the app is deployed to app stores (Google Play, Apple App Store). Post-launch support includes regular updates, bug fixes, and performance monitoring to maintain smooth functionality and improve user engagement.

Results of The Application

Credit Karma helps users achieve greater control over their financial health through credit insights, monitoring, and tailored recommendations.

Improved Credit Scores Over Time

Users benefit from actionable insights, leading to gradual improvement in credit scores and financial stability.

02

Enhanced Financial Awareness

Credit Karma’s tools and reports increase users’ understanding of credit, enabling smarter financial decisions.

Increased Security Against Identity Theft

Real-time alerts help users quickly detect and respond to suspicious credit activity, safeguarding personal finances.

04

Simplified Credit and Financial Management

With easy access to reports and personalized tips, users enjoy a more manageable and informed approach to financial wellness.

Credit Karma App

The Credit Karma app transforms personal finance management, offering users a comprehensive platform to monitor and improve their credit health. With Credit Karma, users gain free access to credit scores, reports, and personalized insights that empower smarter financial decisions.

Credit Score Tracking

Personalized Financial Insights

Credit Monitoring Alerts

Loan and Credit Card Offers

Debt and Expense Management

Your Next Big Idea Starts Here – Schedule Your Free Consultation Today!

Available on Play Store & App Store

Get our app today and start experiencing all the amazing features right from your mobile device.

Download now for the best user experience.

Hear from Our Happy Clients

Want to Discuss a Project?

Discuss your concept, and we’ll help make it happen with a personalized approach, expert guidance, and innovative solutions.

From initial brainstorming to final deployment, our team is dedicated to turning your vision into reality

Take the Next Step Towards Efficiency

Reach out now to discuss your project requirements and get a customized solution that fits your business perfectly.