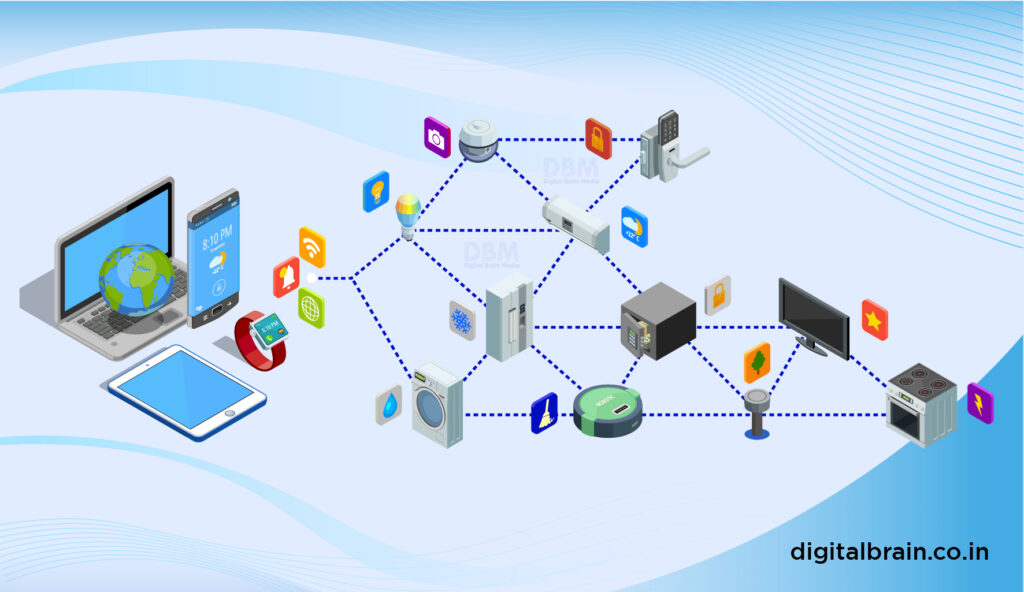

A remittance money transfer solution for businesses is a software platform that enables businesses to send and receive money internationally in a fast, secure, and cost-effective manner.

DBM Provides

Businesses are embracing QR payment apps because they offer contactless transactions, convenience, cost savings, and hence we ensure to deliver the best services

Works with iOS and Android

With two versions of Square Reader for magstripe—one for a headset jack, the other a Lightning connector—you’re covered. Just pick the credit card reader that works for you.

Get paid any way you like with the Square Point of Sale app.

Human resource management (HRM) software

Human resource management (HRM) software is used by businesses of all sizes in a variety of industries. According to a recent study by Statista, the global HRM software market is expected to reach $33.04 billion in 2024.

Get paid any way you like with the Square Point of Sale app.

Overall, HR management software centralizes HR-related data and processes, simplifying administrative tasks, reducing errors, and enabling HR professionals to focus on strategic initiatives and employee well-being.

NEED Remittance Money Transfer Solution

Innovate with mobile app solutions with us, reach us to get started

top industries that use HRM software

Here are some of the top industries that use HRM software:

Healthcare

Healthcare organizations use HRM software to manage their large and complex workforce. HRM software helps healthcare organizations to track employee hours, manage payroll, and comply with complex regulations.

Technology

Technology companies use HRM software to recruit, hire, and retain top talent. HRM software helps tech companies to automate their recruiting process, track employee performance, and offer competitive compensation and benefits packages.

Education

Educational institutions use HRM software to manage their faculty and staff. HRM software helps educational institutions to track employee hours, manage payroll, and track employee performance.

Financial services

Financial services companies use HRM software to comply with strict regulations and manage their risk. HRM software helps financial services companies to track employee compliance training, manage employee certifications, and conduct background checks.

User features

The user features of a parking management system (PMS) can be divided into two main categories: driver features and operator features.

Multiple currencies

Businesses can send and receive money in a variety of currencies, depending on the needs of their customers and suppliers.

Competitive exchange rates

Remittance money transfer solutions typically offer competitive exchange rates, which can help businesses save money on their international payments.

Real-time parking information

Remittance money transfer solutions can typically process payments quickly, so businesses can be confident that their payments will be received on time.

Security

Remittance money transfer solutions use a variety of security measures to protect customer data and financial information.

Compliance

Remittance money transfer solutions are typically compliant with all applicable financial regulations.

License plate recognition

Automatic entry and exit through LPR cameras eliminates the need for tickets or manual validation.

Super admin

User management

You can create, edit, and delete user accounts, as well as view user activity and statistics.

Transfer management

You can view and manage all money transfers, including pending, in-progress, and completed transfers. You can also cancel or refund transfers, if necessary.

Fee management

You can set and manage the fees charged for money transfers.

Compliance management

You can ensure that the remittance money transfer solution is compliant with all applicable financial regulations.

Reporting

You can generate reports on user activity, transfer performance, and other metrics.

System administration

You can manage the system settings and security of the remittance money transfer solution.

Work flow of QR pay

Parking management systems (PMS) work through a combination of hardware and software to automate and streamline various aspects of parking operations. Here’s a breakdown of the key elements:

Sender registration and login

- The sender creates an account on the platform and logs in to access their remittance services.

Enter recipient details

- The sender enters the recipient’s details, such as name, address, and bank account information.

Select transfer amount and currency

- The sender selects the amount of money they want to transfer and the currency they want to transfer it in.

Pay for the transfer

- The sender pays for the transfer using a variety of payment methods, such as bank transfer, credit card, or debit card.

Remittance processing

- The platform processes the remittance and sends the money to the recipient.

Document Management

- HR-related documents, including employment contracts, resumes, and performance reviews, are stored and organized within the system.

Compliance and Reporting

- The software assists HR staff in ensuring compliance with labor laws and regulations.

- It generates HR reports for compliance purposes and provides insights into workforce data.

Analytics and Insights

- HR professionals can analyze data within the software to gain insights into workforce trends and identify areas for improvement.

Security and Access Control

- Access to sensitive HR data is controlled through role-based access permissions, ensuring data security and privacy.

Document Management

- HR-related documents, including employment contracts, resumes, and performance reviews, are stored and organized within the system.

Compliance and Reporting

- The software assists HR staff in ensuring compliance with labor laws and regulations.

- It generates HR reports for compliance purposes and provides insights into workforce data.

Data Backup and Recovery

Super admins can schedule and initiate data backups and develop recovery strategies in case of data loss or system failures.

Integration Management

They can configure and manage integrations with other systems, such as payroll or accounting software, to ensure seamless data exchange.

Audit Trails

Super admins can view and track all actions performed within the system, helping monitor and maintain data integrity.

Merchant features

Merchant features are not typically associated with HR management software. HR management software is designed to serve the needs of human resources professionals, organizations, and employees, focusing on HR-related tasks and processes.

Send money

- Merchants should be able to send money on behalf of their customers to their loved ones abroad. This should be a simple and straightforward process that does not require the merchant to have any specialized knowledge or expertise.

Receive money

- Merchants should be able to receive money from their customers who are living abroad. This can be useful for merchants who sell goods or services online to international customers.

Track transfers

- Merchants should be able to track the status of their customers' money transfers to ensure that the funds are received on time.

Competitive exchange rates

- Merchants should be able to offer their customers competitive exchange rates for their money transfers. This can help to save their customers money and make their remittance service more attractive.

Low fees

- Merchants should be charged low fees for using the remittance money transfer solution. This can help to keep their costs down and make their remittance service more affordable for their customers.

24/7 customer support

- Merchants should have access to 24/7 customer support in case they need assistance with the remittance service.

Merchant features are typically associated with e-commerce and retail businesses, where online transactions, inventory management, payment processing, and order fulfillment are essential.

Support facility

A robust support facility is crucial for any parking management system (PMS) to ensure smooth operation and user satisfaction. Here are some key pillars of a comprehensive support system:

Convenience

Remittance money transfer solutions offer a convenient way to send and receive money internationally. Businesses can send and receive payments from anywhere in the world, without having to go through a bank or other financial institution.

Speed

Remittance money transfer solutions can typically process payments quickly, so businesses can be confident that their payments will be received on time.

Cost-effectiveness

Remittance money transfer solutions typically offer competitive exchange rates and low fees, which can help businesses save money on their international payments.

Security

Remittance money transfer solutions use a variety of security measures to protect customer data and financial information.

Compliance

Remittance money transfer solutions are typically compliant with all applicable financial regulations.

System Updates and Feature Announcements

Clearly communicate system updates, new features, and potential changes to ensure user awareness and adoption.

WHY CHOOSE US?

Security

Remittance money transfer solutions handle sensitive financial data, so it is important to choose a developer who has experience with security best practices. Experts can help you to implement the latest security measures to protect your users' data and financial information.

Reliability

Remittance money transfer solutions need to be reliable and able to handle a high volume of transactions. Experts can help you to develop a platform that is scalable and can meet the needs of your growing business.

Ease of use

Remittance money transfer solutions should be easy to use for both senders and recipients. Experts can help you to design a user-friendly platform that is accessible to people of all levels of technical expertise.

FAQ

A remittance money transfer solution platform is a software platform that enables businesses and individuals to send and receive money internationally in a fast, secure, and cost-effective manner.

Remittance money transfer solution platforms play an important role in the global economy by facilitating the transfer of money between people living in different countries. This money is often used to support family and friends, pay for goods and services, and invest in businesses.

The key features of a remittance money transfer solution platform include:

- Competitive exchange rates: The platform should offer competitive exchange rates for money transfers.

- Low fees: The platform should charge low fees for money transfers.

- Fast transfer times: The platform should be able to process transfers quickly and efficiently.

- Multiple payment methods: The platform should offer a variety of payment methods for users to choose from.

- Multiple currencies: The platform should allow users to send and receive money in multiple currencies.

- Security and compliance: The platform should use the latest security measures to protect user data and financial information. The platform should also be compliant with all applicable financial regulations.

There are many benefits to using a remittance money transfer solution platform, including:

- Convenience: Remittance money transfer solution platforms offer a convenient way to send and receive money internationally. Users can send and receive money from anywhere in the world, without having to go through a bank or other financial institution.

- Speed: Remittance money transfer solution platforms can typically process transfers quickly and efficiently, so users can be confident that their money will be received on time.

- Cost-effectiveness: Remittance money transfer solution platforms typically offer competitive exchange rates and low fees, which can help users to save money on their transfers.

- Security: Remittance money transfer solution platforms use a variety of security measures to protect user data and financial information.

- Compliance: Remittance money transfer solution platforms are typically compliant with all applicable financial regulations.

The cost of developing a remittance money transfer solution platform will vary depending on the features and functionality of the platform, as well as the complexity of the project. However, it is important to note that developing a remittance money transfer solution platform is a significant investment.

The time it takes to develop a remittance money transfer solution platform will vary depending on the complexity of the project. However, it is important to note that developing a remittance money transfer solution platform is a time-consuming process.

There are a number of challenges involved in developing a remittance money transfer solution platform, including:

- Security: Remittance money transfer solutions handle sensitive financial data, so it is important to implement robust security measures to protect user data and financial information.

- Compliance: The remittance industry is subject to complex regulations, so it is important to ensure that the platform is compliant with all applicable regulations.

- Integrations: Remittance money transfer solutions need to be integrated with a variety of payment methods and financial institutions.

When choosing a developer for your remittance money transfer solution platform project, it is important to consider the following factors:

- Experience: Choose a developer who has experience developing remittance money transfer solutions.

- Expertise: Choose a developer who has expertise in the relevant technologies and programming languages.

- Portfolio: Review the developer's portfolio to assess their work quality and experience.

- References: Ask the developer for references from previous clients.

- Communication: Choose a developer who is communicative and responsive.

Some of the latest trends in remittance money transfer solution platform development include:

- Blockchain: Blockchain technology is being used to develop remittance money transfer solutions that are more secure, transparent, and efficient.

- Artificial intelligence (AI): AI is being used to develop remittance money transfer solutions that can better understand user needs and provide personalized recommendations.

- Machine learning (ML): ML is being used to develop remittance money transfer solutions that can detect and prevent fraud.